About Us

Derivatas is an end-to-end valuation solution for financial reporting (ASC 820, ASC 718), tax compliance (IRC 409A), and deal analyses. Founded by experienced valuation professionals, Derivatas combines deep industry expertise with the latest technology in cloud computing and data analytics to bring you the most advanced valuation platform in the industry. Since its inception in 2011, Derivatas has become one of the most trusted valuation service providers by some of the most prominent venture capital and accounting firms. Whether you are looking for valuation services or a self-valuation platform, Derivatas is your partner of choice.

Derivatas is a proud partner of the National Venture Capital Association and is the preferred 409A valuation service partner for Keiretsu Capital, the largest angel investing network in North America.

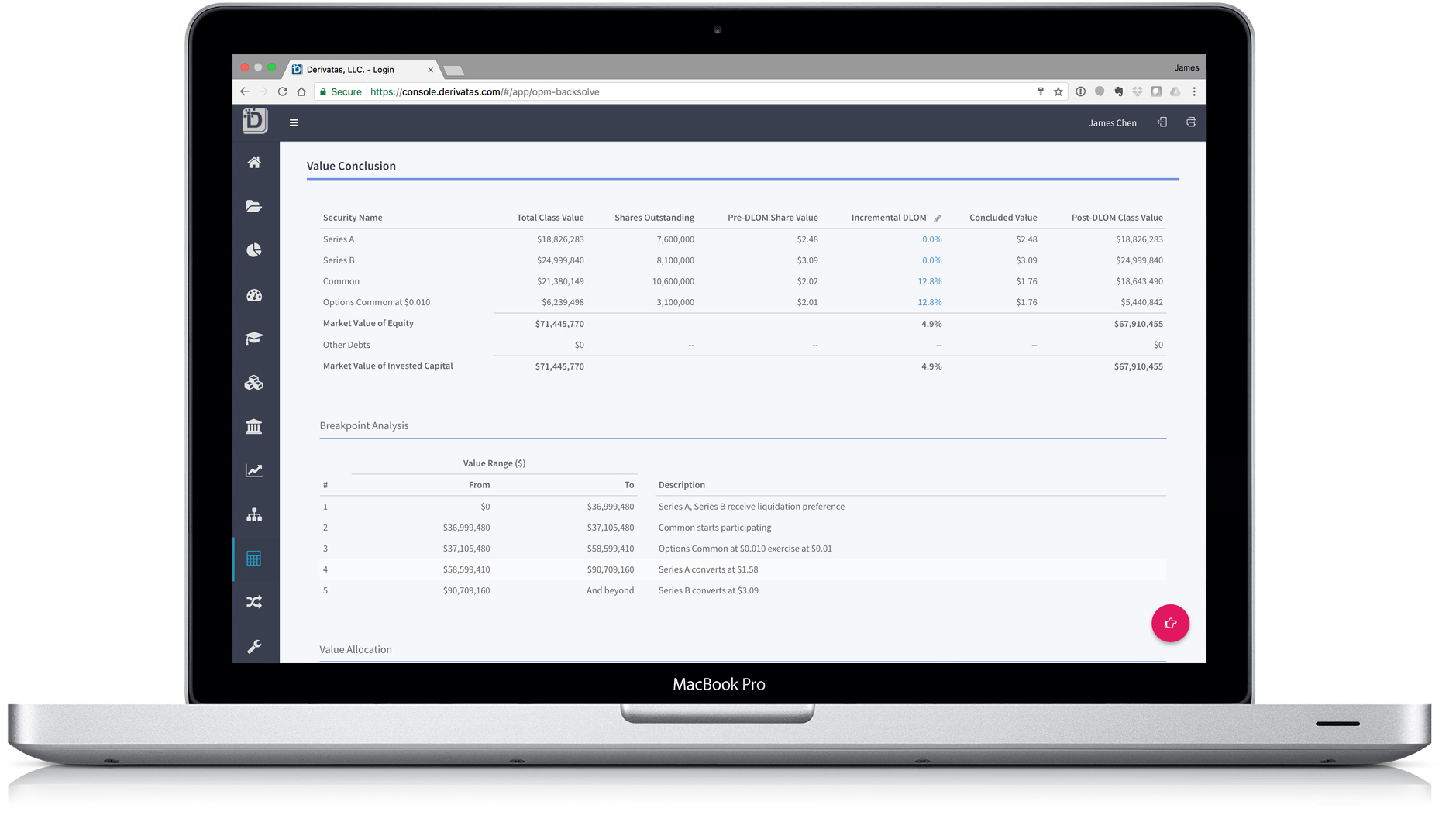

Self-Valuation Platform

Intuitive and powerful. Funds, startups, auditors and other service providers can now easily and confidently perform, manage, store and share all their valuations using the latest methodologies with 100% assurance of accuracy.

Support for Complex Securities

Customizable GUI-based Workflow

Scenarios & Sensitivity Analysis

S&P Capital IQ Integration

Audit-Ready Report Generation

Excel Data Export

Portfolio Management Tools

Sharing & Collaboration

Email & Phone Support

Full Service Valuations

We are specialists in valuations for venture capital funds and the companies they finance – it’s all we do. Our focus makes us the best at what we do.

Venture Capital & Private Equity — ASC 820 Fair Value Measurement

- Full Service ASC 820 Valuation

At Derivatas, expect nothing less than the best. As a full service portfolio valuation client you will receive:

- Best in class valuation reports

- Qualified valuation professionals with decades of experience working for and with Big 4 accounting firms

- Full audit support on all valuations

- Cost effectiveness and quick turnaround time

Startup — 409A Valuation

- Full-Service IRC 409A Valuation

Derivatas eliminates your financial compliance headaches so you can focus on growing your business. Our services include:

- Compliance with IRC 409A and ASC 718 standards

- Full audit support if needed

- Fast turnaround (usually 3-5 business days)

- Competitive pricing & unmatched quality

Trustworthy Valuations

At Derivatas we stand behind our work. If you are ever challenged to defend the valuations performed by Derivatas, we will assume responsibility for explaining and defending our valuations with auditors, the IRS or the SEC.

Testimonials

-

Derivatas was initially referred to us by a BIG 4, and they came highly regarded. The Derivatas professionals know exactly how to work with our BIG 4 auditors along with our finance team to foster a collaborative and trusting environment. Their deep expertise and strong relationship skill have carried us through several audit cycles already. Can’t say enough how much we love working with them!

Cinthia Sheu VP Finance, Vivo Capital -

Derivatas provided a 409a valuation for a client requiring a significant change versus a prior valuation by another firm. They helped us understand why the new valuation methodology would be necessary for the company to survive a future audit and avoid a potentially damaging outcome. Working with Derivatas was both enjoyable and enlightening, and I will be using them with all my clients in the future.

Scot Mollot Interim CFO in Silicon Valley -

The Derivatas team has always provided an easy to follow analysis in a clear and detailed overview format. They provide a knowledgeable interface with auditors and a quick turnaround on reports. They are reliable and have saved us a lot of time and headaches.

Daniel Barakat VP Finance, e.ventures -

We had a great experience working with Derivatas. Your team was so helpful, and you saved us a lot of time and money. And our auditors were very complimentary of the quality of your report.

Dale Fox CEO, Tribogenics, Inc.

Leadership Team

The Derivatas team has performed some of the most difficult valuations, reviewed thousands of third-party valuations, and are well-versed with the auditing processes from the top firms in the country. We draw from all these experiences to give our customers unparalleled service.

Ready to begin?

Contact us today to discuss your valuation needs

THOUSANDS OF VALUATIONS PERFORMED

Contact Us

Phone: +1 (213) 995-6195 Email: inquiries@derivatas.com Address: 11103 West Ave 2101, Suite 133 San Antonio, TX 78213